Indices

Trade on Basket of top shares representing the performance of a country’s economy. Choose from over 90 cash and forward indices instrunments, including the UK 100, US 30and Germany 30

What are Indices ?

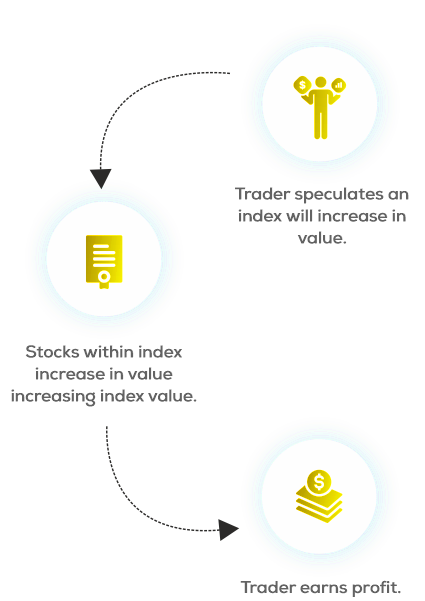

Indices offer a great way for you to trade on the overall value of a regional index without having to analyse individual companies or stocks. The index itself represents the value of a group of stocks from one country and shows the overall, current, and historical performance of that stock index.

There are many types of indices available to trade at spot price or through forward trading. Economic news such as interest rate freezes, inflation and rises in spending can all cause the value of Indices to rise or fall. In some respects, bigger companies can affect the performance of a particular index due to their size and market dominance.

What are Indices ?

Each index measures a group of the stock market. Usually, the group is a country but it can be just an industry sector, like technology or industrial. Here are the most popular:Dow Jones (DJ 30), is made up of the 30 biggest industrial companies in the U.S.S&P 500, It represents 500 companies from the U.S.NASDAQ 100, measures the 100 major tech companies in the U.S.DAX 30, it’s the German index. It includes the 30 leading German companies.FTSE 100, groups the top 100 companies of the U.K.CAC 40, represents the best 40 French companies.NIKKEI 225, it’s the index from Japan. It contains the 225 biggest companies in the country.

Why Us?

Reason TO Choose BotX

01. 40+ Currency Pairs

Choose from our wide selection of 40+ FX currency pairs and seize diverse trading opportunities.

02. Low minimum deposits

Experience the flexibility of low minimum deposits, allowing you to start trading with ease.

03. Low Spread

Our low spreads will ensure you get the most out of your trades. So why wait? Sign up today and see the difference BotX can make for yourself!

04. Trade on leverage upto 1:1000

Amplify your trading power with leverage up to 1:1000, maximizing your potential in the markets.

BotX is a leading Forex Broker and has been providing traders with trading options like crypto, currencies, stocks, commodities, indices and many other. With 65 plus countries existing makes BotX the best forex broker for all your needs.

Our Community

Here you’ll find regular market updates, expert tips & stories.

Phone

+919999999999

support@botxcapital.com

Useful Links

BotX – incorporated in Saint Lucia under number 2023-00249 which registered office is at Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia.

Risk Warning- Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. BotX Capital Markets Ltd does not offer its services to residents of certain jurisdictions such as the USA, Iran, North Korea, Indonesia & FATF Blacklisted courtries.

Restricted Regions: BotX does not provide services to residents of the USA, Canada, Syria and FATF black listed countries.